Related Articles

- The Role of Quantum Encryption in Transforming Legacy Data Protection Practices for Businesses

- Top 6 AI-Powered Subscription Platforms Transforming Product Access and Affordability Since 2019

- Unseen Pitfalls: How Cognitive Overload in Finance Audits Undermines Checklist Effectiveness and Decision Quality

- The Silent Impact of Global Fiscal Shifts on Local Tax Date Practices No One’s Talking About

- How Cultural Narratives Shape Personal Budgeting: Unseen Influences Behind Financial Template Choices

- Top 6 Underrated Payment Tools Released Since 2019 Changing How Stores Handle Transactions

8 Innovative Budget Finance Templates to Streamline Cash Flow Management for Small Businesses

8 Innovative Budget Finance Templates to Streamline Cash Flow Management for Small Businesses

8 Innovative Budget Finance Templates to Streamline Cash Flow Management for Small Businesses

Effective cash flow management is the lifeblood of any small business. Without clear visibility into finances, even the most promising ventures can falter. Budget finance templates serve as practical tools that help entrepreneurs plan, track, and optimize their cash flow. By leveraging innovative and easy-to-use templates, small business owners can gain a clearer understanding of their financial landscape, facilitating more informed decisions.

From monthly budgeting to expense tracking, each template is designed to simplify complex financial data into actionable insights. This article explores eight innovative budget finance templates, providing an overview of their key features and benefits. Employing these resources can not only save time but also empower small businesses to maintain financial stability and promote sustainable growth.

These templates are particularly beneficial for small businesses that may lack dedicated financial personnel. They provide structure and consistency in managing finances, which is crucial for avoiding cash shortages and capitalizing on investment opportunities. Whether new to budgeting or seeking to optimize current practices, small business owners will find value in the following selections.

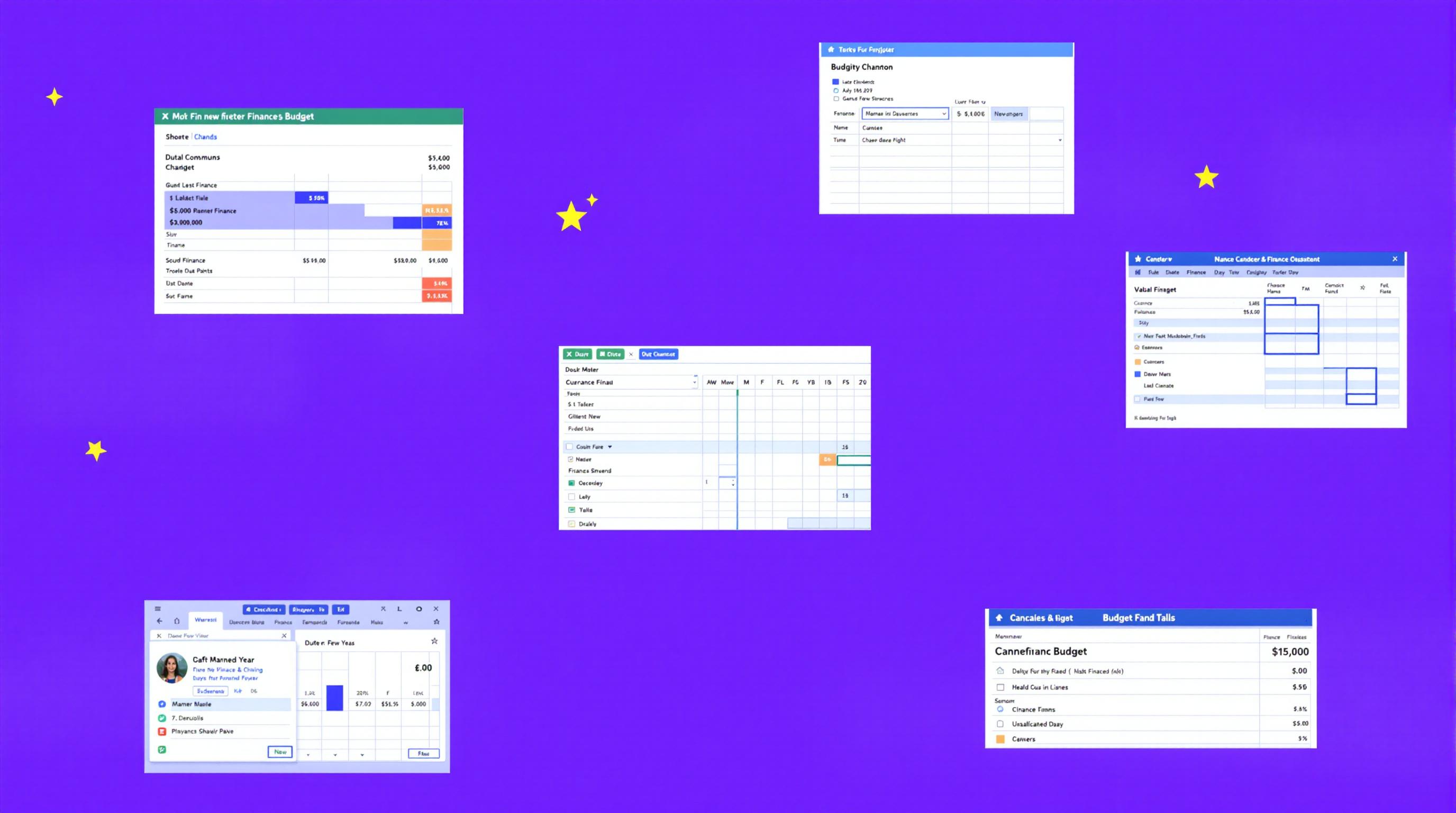

1. Monthly Budget Planner Template

The Monthly Budget Planner Template offers a straightforward approach for mapping expected income against planned expenses on a monthly basis. It enables businesses to forecast revenues, categorize expenditures, and track variances. This proactive planning assists in anticipating cash shortfalls before they occur.

By breaking down budgets into discrete categories such as payroll, supplies, and marketing, small business owners gain detailed visibility. This categorization supports strategic adjustments when certain costs exceed projections. The template's simplicity caters to users with varying financial expertise.

Adopting a Monthly Budget Planner aligns with best practices recommended by financial advisors (Investopedia, 2023). Regular updating of this template ensures that budget projections remain relevant and reflective of actual cash flow trends.

2. Cash Flow Forecast Template

The Cash Flow Forecast Template projects inflows and outflows over a defined period, often weekly or monthly. This template is instrumental in highlighting expected liquidity surpluses or deficits, allowing businesses to plan accordingly, such as timing vendor payments or seeking short-term financing.

When used consistently, the Cash Flow Forecast acts as an early warning system. Businesses can mitigate risks of insolvency by adjusting spending or increasing collections based on forecasted data. This financial foresight enhances operational resilience.

Experts emphasize the importance of cash flow forecasting in small business success (U.S. Small Business Administration, 2022). The template supports this critical function by providing a structured framework for ongoing analysis.

3. Expense Tracking Template

Maintaining meticulous records of expenses is fundamental to accurate budgeting. The Expense Tracking Template offers a detailed ledger for recording and categorizing each purchase, enabling businesses to monitor spending habits and identify cost-saving opportunities.

By regularly analyzing expense data, small businesses can streamline operations and reduce unnecessary outflows. This template promotes accountability and financial discipline by fostering transparency in spending.

According to financial studies, granular expense tracking contributes to improved profitability (Journal of Small Business Finance, 2021). Employing this template anchors prudent expenditure management in daily practices.

4. Sales Tracking and Revenue Projection Template

Understanding sales trends enhances revenue forecasting and budget accuracy. The Sales Tracking and Revenue Projection Template records actual sales figures alongside projected estimates, identifying discrepancies and guiding inventory and marketing decisions.

This template facilitates scenario planning by allowing businesses to simulate revenue outcomes based on varying sales volumes. Such analysis supports strategic budgeting aligned with market realities.

Using revenue projection tools aligns with recommendations from market analysts who stress data-driven budgeting approaches for small enterprises (Forbes Small Business, 2023).

5. Break-Even Analysis Template

The Break-Even Analysis Template calculates the point at which total revenues equal total costs, indicating when a business becomes profitable. This insight is essential for pricing strategies and understanding the minimum sales required to cover expenses.

Small businesses can use this template to evaluate the financial viability of new products or services before significant investment. It promotes informed decision-making by quantifying risk thresholds.

Financial educators underscore the importance of break-even analysis in entrepreneurial financial planning (Harvard Business Review, 2022). Incorporating this template aids in establishing realistic business objectives.

6. Debt Repayment Schedule Template

Managing liabilities effectively reduces financial stress and preserves creditworthiness. The Debt Repayment Schedule Template helps businesses organize loan repayments, interest schedules, and principal balances over time for clearer cash flow impact visualization.

By tracking repayment commitments, small business owners can prioritize debts, avoid penalties, and strategize refinancing options as needed. This template also assists in aligning debt obligations with available cash resources.

Financial management literature highlights structured debt tracking as a cornerstone of responsible business finance (Small Business Trends, 2023). This template embodies such principles through practical application.

7. Inventory Budget Template

Controlling inventory costs is critical to sustain healthy cash flow. The Inventory Budget Template enables businesses to estimate purchasing needs based on sales forecasts and current stock levels, thereby minimizing overstocking or stockouts.

This template helps balance inventory investment with operational liquidity, reducing capital locked into unsold goods. Timely adjustments in inventory budgeting improve overall financial agility.

Retail and manufacturing sectors particularly benefit from inventory budgeting as demonstrated in industry reports (National Retail Federation, 2022). Applying this template supports best practices for inventory management.

8. Profit and Loss Statement Template

The Profit and Loss Statement Template summarizes revenues, costs, and expenses over a period, revealing net profit or loss. This comprehensive financial snapshot informs budgeting by clarifying overall business performance.

Regular use of this template aids small businesses in tracking financial progress against goals and identifying areas needing attention. It serves as a foundational document for tax preparation and stakeholder reporting.

Accounting standards affirm the Profit and Loss Statement as essential in financial transparency and decision-making (American Institute of CPAs, 2023). Incorporating this template ensures adherence to such standards.

9. Project Budget Template

For businesses undertaking specific projects, the Project Budget Template allows detailed planning of all related costs, including labor, materials, and overheads. This tool ensures projects stay within financial parameters and deadlines.

By tracking expenses against budgeted amounts, businesses can detect potential overruns early. It also facilitates resource allocation decisions and project feasibility assessments.

Project budgeting techniques are critical in successful project management, as noted by the Project Management Institute (PMI, 2023). Employing this template aligns small business projects with professional standards.

10. Cash Flow Statement Template

The Cash Flow Statement Template provides a reconciliation of operating, investing, and financing activities, showing net cash movement over time. This detailed view complements forecasts by verifying actual cash positions.

Tracking cash flows helps businesses maintain liquidity, plan investments, and prepare contingency measures for cash shortages. Regular review of this statement supports financial health and strategic growth.

According to financial analysts, combining cash flow statements with budgeting enhances decision accuracy (CFO Magazine, 2023). Small businesses benefit from adopting this comprehensive financial tool.

Utilizing these eight innovative budget finance templates empowers small businesses to embrace structured financial management practices. Through timely and consistent application, entrepreneurs can mitigate risks, optimize resources, and ultimately build sustainable enterprises.