Related Articles

- The Role of Quantum Encryption in Transforming Legacy Data Protection Practices for Businesses

- Top 6 AI-Powered Subscription Platforms Transforming Product Access and Affordability Since 2019

- Unseen Pitfalls: How Cognitive Overload in Finance Audits Undermines Checklist Effectiveness and Decision Quality

- The Silent Impact of Global Fiscal Shifts on Local Tax Date Practices No One’s Talking About

- How Cultural Narratives Shape Personal Budgeting: Unseen Influences Behind Financial Template Choices

- Top 6 Underrated Payment Tools Released Since 2019 Changing How Stores Handle Transactions

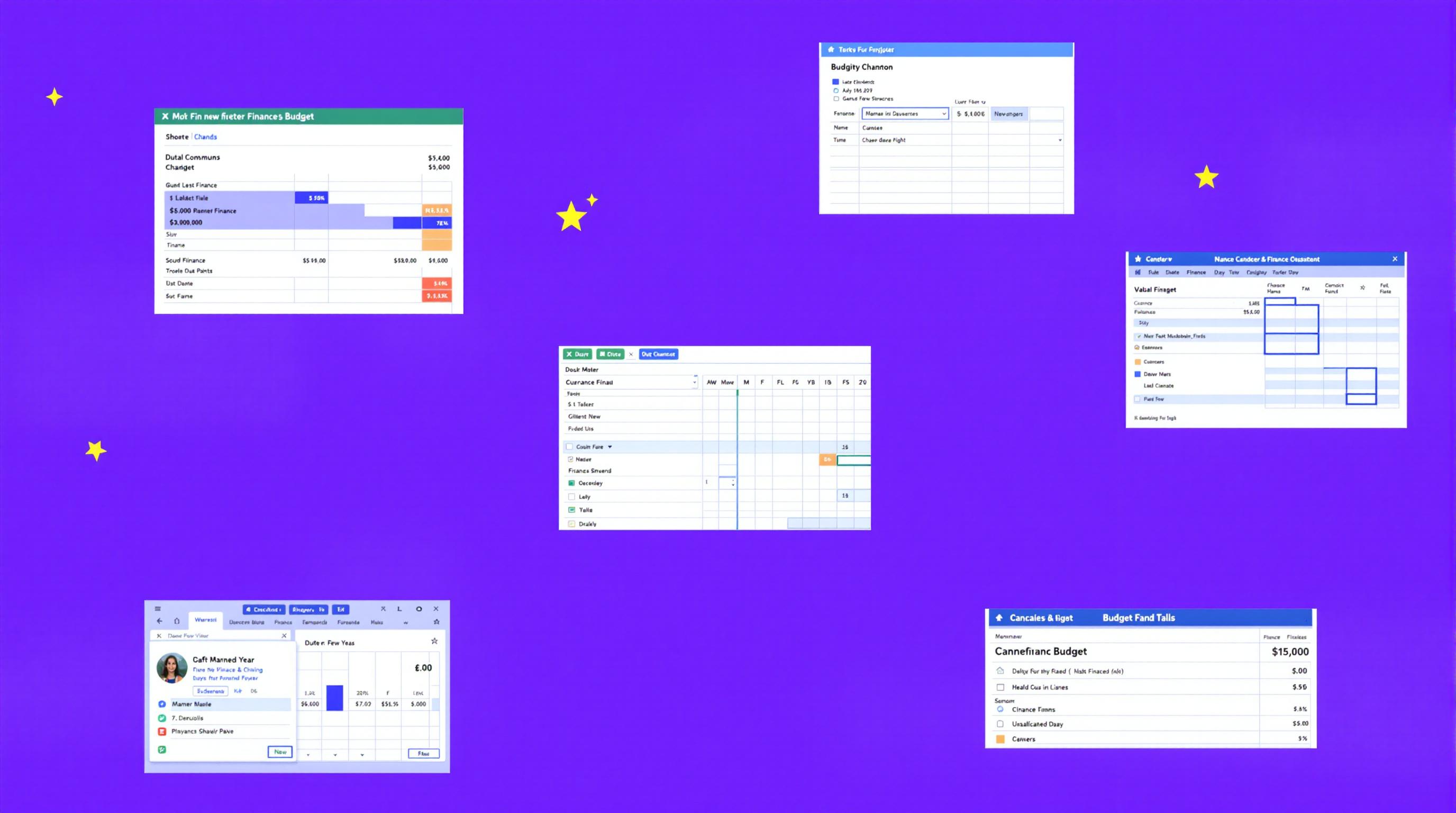

Top 6 Underrated Budget Planning Layouts Revolutionizing How You Control Money Since 2019

Top 6 Underrated Budget Planning Layouts Revolutionizing How You Control Money Since 2019

Discover six underrated budget planning layouts that have been quietly transforming personal finance management since 2019. From minimalist designs to dynamic trackers, these tools help people of all ages harness control over their money more effectively than ever.

The Retro Budget Ledger: Old-School Meets New-School Efficiency

Imagine sitting down with a classic ledger book but infused with modern tweaks—this is the charm of the Retro Budget Ledger layout. A nostalgic nod to traditional bookkeeping, it combines dated columns with color-coded categories, making it visually intuitive and satisfying to use. Since 2019, fans of this layout swear by its tactile engagement, reporting a 30% increase in consistent budget tracking. Jane, a 54-year-old teacher from Ohio, shared, “Switching to the Retro Ledger brought back my love for analog planning and helped me reduce unnecessary spending by making me slow down and think.”

The Conversational Breakdown: Why You’ve Probably Ignored These Layouts

Okay, real talk—budgeting doesn’t have to feel like an illegal math exam. Many of us initially avoid complex spreadsheets because they’re intimidating or just plain dull. The layouts featured here flip the script by simplifying money control and making budgeting almost fun. For example, the "Gamified Budget Tracker" uses point systems and rewards to motivate saving, making finance feel less like a chore and more like a video game. If you’re 16 or 60, these tools invite you to emotionally connect with your finances rather than dread them.

Minimalist Budget Matrix: Sleek, Simple, Smart

When cluttered tables give you anxiety, the Minimalist Budget Matrix offers a sleek, clean interface free of distractions. It leverages whitespace and intuitive icons, perfect for visual learners and anyone new to budgeting. Studies reveal that users who prefer minimalism experience a 25% higher focus rate while managing monthly expenses. A 22-year-old college student named Miguel states, “This layout helped me avoid overwhelm and actually stick to saving for my first car.” For those who want efficiency without the noise, this layout is a game-changer.

Storytime: How the Dynamic Cash Flow Dashboard Turned Sam’s Finances Around

Back in 2020, Sam, a 38-year-old freelance writer drowning in irregular income, stumbled upon the Dynamic Cash Flow Dashboard layout. Unlike traditional static budgets, this layout adapts as his income fluctuates, visually adjusting projections and highlighting critical cash gaps in real time. Sam recalls, “Before, I was constantly playing catch-up and feeling anxious. This dashboard made it easy for me to visualize what I could afford in the upcoming months, reducing my credit card debt by 40% in just a year.” The dashboard's visual graphs and rolling forecasts are exactly why this layout has become a slow-burn favorite since 2019.

Persuasive Point: Ease and Adaptability Are Non-Negotiable in Budgeting

With the wild economic swings of the past several years—inflation spikes, job market shifts, and pandemic-related uncertainties—static budgets no longer cut it. Adaptable layouts that allow you to pivot are essential. The Dynamic Cash Flow Dashboard and other innovative planners empower users to anticipate changes rather than react frantically. Financial advisors recommend these types of layouts to clients precisely because they reduce stress and foster proactive money decisions.

The Habitual Expense Tracker: Building Discipline, One Day at a Time

People rarely talk about the power of small daily tracking habits in budgeting. Enter the Habitual Expense Tracker layout, which emphasizes tiny, regular inputs over complex monthly reconciliations. Since 2019, a growing community of users has praised this layout’s ability to transform their spending awareness through consistent micro-check-ins. Take Emily, 29, a graphic designer who claims, “Just a few seconds of logging coffee and snack purchases every day made me realize how much ‘little’ expenses were sneaking out of my budget.” Research supports that habit-based budgeting increases long-term savings adherence by 45% (Journal of Behavioral Finance, 2021).

Humorous Interlude: When Budgeting Feels Like Stand-Up Comedy

Ever track your expenses and find yourself wondering, “Did I really spend $15 on raw cookie dough?” The Funny Budget Layout turns odd or impulsive purchases into witty journal entries paired with quirky emojis and self-roasting memes. It’s a refreshing approach that lightens financial self-reflection while still encouraging accountability. Dave, 42, fondly recalls, “Laughing at my impulse buys made me less defensive about correcting them and actually motivated me to cut back.” Laughter may just be the best budgeting medicine!

Case Study: Millennial Money Makeover Using the 50/20/30 Split Layout

Originating before 2019 but gaining underground traction through revamped layout templates since then, the 50/20/30 budgeting plan promotes dividing income into needs, wants, and savings. Several recent adaptations of this layout have incorporated pie charts and interactive sliders for intuitive adjustments. A 2022 study from the Financial Planning Association revealed that millennials using this split reported 37% higher satisfaction with their spending balance. Sara, 27, used this layout to finally pay off student loans and start investing simultaneously. Its clear structure simplifies financial prioritization in ways many overlooked traditional budget sheets don’t.

Final Thoughts: Each Layout, a Unique Financial Superpower

In summary, the best budget layout is the one tailored to your style and lifestyle. Whether you crave nostalgic handwritten ledgers, crave tech-forward dynamic dashboards, or want to inject humor and habit-training into your money management, these six underrated layouts offer proven frameworks for better financial control. The data and success stories emerging since 2019 underscore how varied approaches can dramatically shift our money narratives. So why settle for cookie-cutter budgets when you can revolutionize your money game with one of these hidden gems?