Related Articles

- The Role of Quantum Encryption in Transforming Legacy Data Protection Practices for Businesses

- Top 6 AI-Powered Subscription Platforms Transforming Product Access and Affordability Since 2019

- Unseen Pitfalls: How Cognitive Overload in Finance Audits Undermines Checklist Effectiveness and Decision Quality

- The Silent Impact of Global Fiscal Shifts on Local Tax Date Practices No One’s Talking About

- How Cultural Narratives Shape Personal Budgeting: Unseen Influences Behind Financial Template Choices

- Top 6 Underrated Payment Tools Released Since 2019 Changing How Stores Handle Transactions

7 Cutting-Edge Finance Audit Checklist Tools Released Since 2019 That Revolutionize Compliance Efficiency

7 Cutting-Edge Finance Audit Checklist Tools Released Since 2019 That Revolutionize Compliance Efficiency

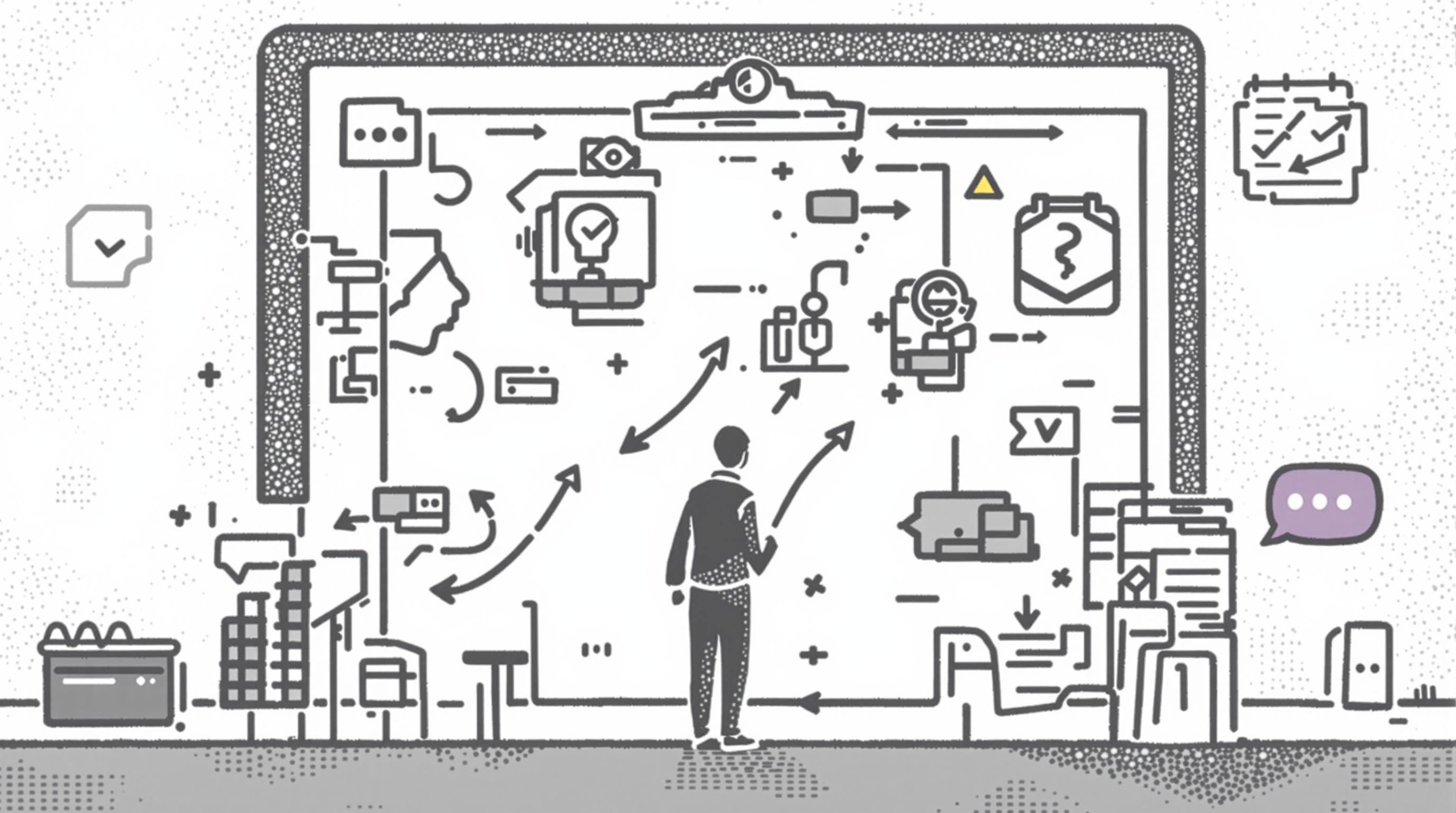

Seven innovative finance audit checklist tools launched since 2019 have dramatically boosted compliance efficiency across industries worldwide. This article explores how these solutions, each unique in approach and technology, streamline auditing processes, reduce errors, and transform regulatory adherence.

An Auditor’s Tale: When Compliance Meets Technology

At 64, with decades of experience navigating the labyrinth of finance audits, I’ve witnessed firsthand how traditional checklists often felt like ticking boxes in the dark. Then came the revolution: introducing dynamic audit checklist tools that illuminate every corner of compliance. One case involved a mid-sized firm that cut its audit cycle from six weeks to just ten days after adopting one such tool.

1. AuditBoard: The Cloud-Based Dynamo

Since 2019, AuditBoard has been a leader in cloud-powered audit management. This platform integrates checklist creation, task assignment, and real-time status updates, enabling auditors to monitor compliance across multiple departments simultaneously.

According to a report by Gartner (2021), organizations using AuditBoard saw an average 40% reduction in audit preparation time.

How AuditBoard Boosts Efficiency

Its intuitive dashboard allows auditors to customize compliance checklists easily and attach relevant documentation. Plus, the system features automated reminders that prevent overlooked steps—a common pitfall in manual checklists.

2. Smartsheet: Collaboration Meets Compliance

Imagine a tool that combines project management ease with auditing precision. Smartsheet offers customizable finance audit templates and checklists that stakeholders can collaborate on in real-time, regardless of where they are in the world.

In 2020, a multinational corporation reported a sharp decline in compliance issues after switching to Smartsheet’s audit solutions, highlighting its impact in complex, cross-border audits.

A Statistical Edge: The Data-Driven Advantage

Did you know that 62% of companies surveyed by PwC in 2022 cited inefficient manual compliance processes as their biggest bottleneck? That is precisely why modern financial audit checklist tools leverage artificial intelligence, automation, and cloud computing to expedite and error-proof audits.

3. MindBridge Ai Auditor: The AI-Powered Innovator

Smart, sleek, and terrifyingly effective, MindBridge Ai Auditor uses machine learning algorithms to analyze entire datasets rather than samples, detecting anomalies that traditional checklists might miss.

The company’s clients report up to a 5x increase in fraud detection rates, proving that AI can be a game-changer in compliance.

Quick Example:

A Canadian bank used MindBridge to flag fraudulent transactions embedded in millions of records, saving millions of dollars in potential losses.

4. Workiva: Compliance Meets Innovation

Workiva empowers finance teams with integrated audit and compliance checklist tools that connect data, documents, and teams. Since 2019, its platform has been pivotal for organizations that require synchronized reporting and auditing across global operations.

For instance, a European energy company credited Workiva with reducing their SOX compliance costs by 30% in just one fiscal year.

Conversational Take: Let’s Talk About the Next-Gen Finance Auditors

Hey there! So you’re curious about what’s pushing audit checklists into the 21st century? Tools like these aren’t just boring software; they’re like your audit team’s new best friends—smart, fast, and super reliable. Ever tried juggling a dozen spreadsheets? Yeah, these tools take that chaos and turn it into a smooth process.

5. Resolver: Risk Management Meets Audit Checklists

Though established before 2019, Resolver released a revamped compliance checklist feature post-2019, focusing on risk-based auditing. Its software not only tracks audit steps but also evaluates risk levels linked to each item, prioritizing effort where it matters most.

Companies that use Resolver report a 25% improvement in risk identification accuracy, according to Resolver’s 2021 client survey.

6. Idea: Unified Analytics for Auditors

Released its latest audit checklist modules in 2020, Idea combines data analytics with checklist workflows, ensuring auditors can infer insights while ticking off tasks. This integrated approach minimizes disjointed processes, which often cause delays and errors.

One noteworthy example includes a financial services firm that improved audit turnaround times by 20% after adopting Idea’s tools.

Fun Fact:

Using analytics in audit checklists helps detect not just errors, but also strategic opportunities—turning compliance into a competitive edge.

7. Checkpoint Engage: Thomson Reuters’ Audit Solution

Checkpoint Engage, from the giant Thomson Reuters, offers an extensive and regularly updated library of audit checklists, designed in accordance with ever-evolving regulations. Its interactive platform also enables auditors to answer questions and capture evidence digitally.

Since its 2021 upgrade, user satisfaction ratings jumped by 15%, reflecting increased efficiency and ease of use.

The Future Is Now

With these tools, the image of auditors drowning in paperwork is becoming a relic of the past. Organizations tapping into these cutting-edge checklist technologies experience faster, more accurate audits and become more agile in responding to regulatory demands.

However, it’s crucial that firms thoughtfully integrate these tools with knowledgeable professionals to maximize benefits, because technology, after all, is most powerful when paired with expertise.

Wrapping Up with a Persuasive Perspective

If you’re in finance or compliance, adopting one of these seven audit checklist tools isn’t just a smart move—it’s essential. As regulatory environments grow more complex, relying on outdated manual methods is not just risky but inefficient. Embrace these tools to transform compliance from a dreaded obligation into a streamlined, value-adding process.

The numbers don’t lie: faster audits, fewer errors, and improved risk management translate directly into saved costs and stronger governance.

Sources:

- Gartner (2021), “Market Guide for Audit Management Software”

- PwC (2022), “Global State of Compliance Study”

- Resolver Client Survey (2021)

- Company case studies provided by AuditBoard, MindBridge, Workiva, and Thomson Reuters